Problem Solving Forums and High Risk Homeowners Insurance

The Insurance Landscape: Shrinking Options and Expanding Risk

Reddit Weighs In on High-Risk Homeowners Insurance: Frustration, Fear, and a Broken System

A recent Reddit post on r/insurance sparked a fiery and revealing discussion about high-risk homeowners insurance—an increasingly urgent issue across the U.S. as homeowners grapple with nonrenewals, rising premiums, and limited options. The thread quickly filled with stories from frustrated homeowners, insurance agents, and even a few underwriters, painting a complex picture of a system under serious stress.

The original poster (OP), a California homeowner, shared that their longtime insurance provider had dropped them following two weather-related claims in three years. Their home hadn’t changed, but they were now considered "high risk" and left scrambling for a replacement policy. The only offer they received was through the state FAIR Plan—at nearly double the cost and with far less coverage.

The Insurance Landscape: Shrinking Options and Expanding Risk

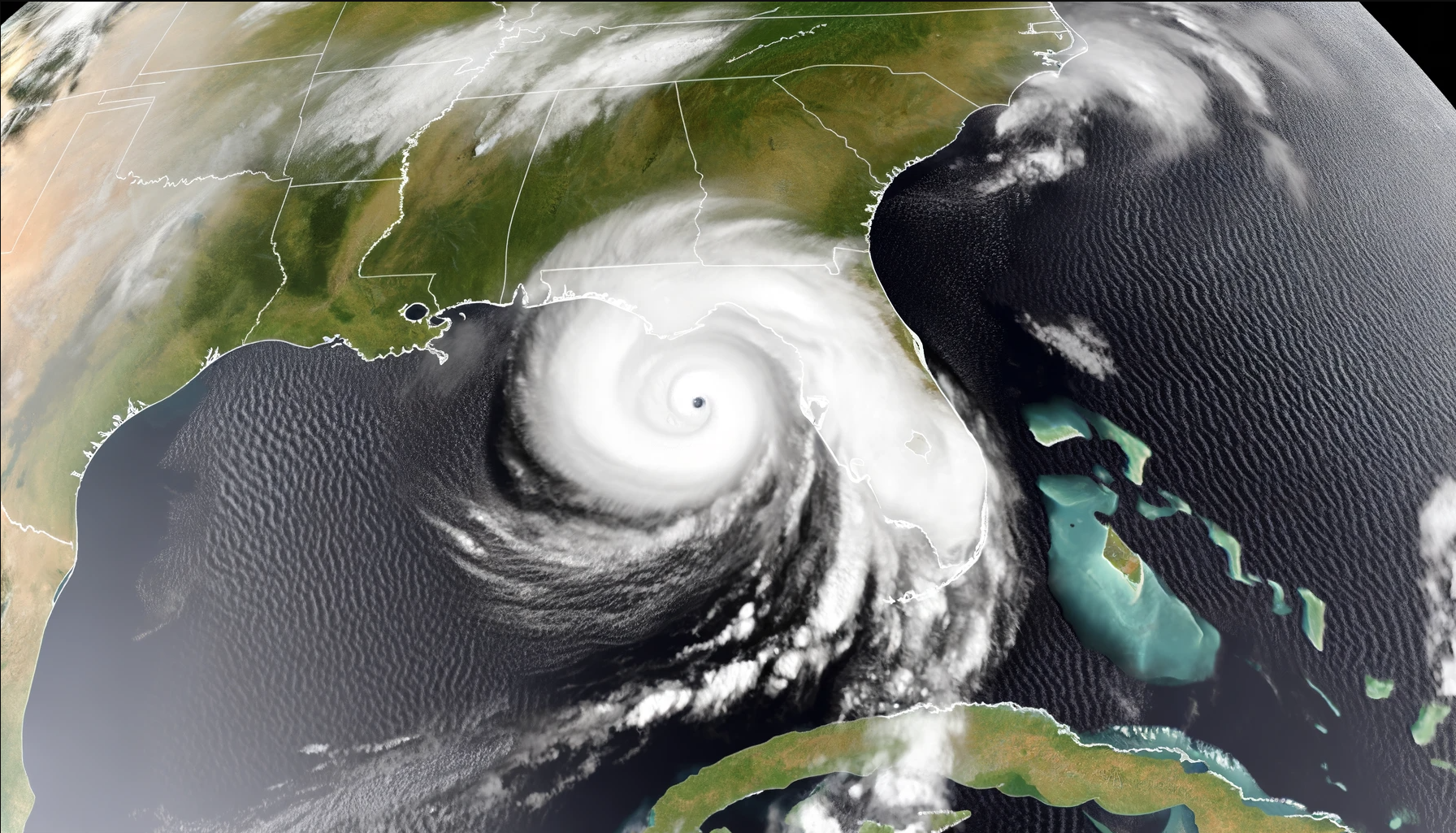

What emerged from the comments was a common theme: fewer insurers are willing to write policies in areas prone to wildfires, hurricanes, or flooding. Carriers are pulling out of entire states—California, Florida, and Louisiana being the most often mentioned—and those remaining are raising deductibles, reducing coverage, or requiring expensive mitigation work.

The result? Many homeowners are left with just two choices: pay sky-high premiums or go without coverage altogether. Several users reported turning to their state's FAIR Plan or last-resort program, only to be shocked by the limited protection and the hoops they had to jump through to even qualify.

Consumer Sentiment: Fear, Confusion, and Anger

The tone of the Reddit thread ranged from resignation to outrage. One commenter from Florida described watching their premiums triple despite no claims. Another, from Colorado, lamented that "owning a home now feels like gambling with my future." A few shared the emotional toll of being denied coverage entirely, feeling punished for simply living where they do.

What stood out was how little most homeowners understood about how risk is assessed or why their coverage had changed. Insurance company decisions, based on complex models involving weather patterns, claim frequency, and reinsurance markets, were viewed as arbitrary and opaque. Many accused the industry of abandoning middle-class homeowners while continuing to insure luxury properties and commercial clients.

How It's Sold: Distribution Model Frustrations

Several agents weighed in, revealing the difficulties they face helping clients in high-risk areas. Unlike the direct-to-consumer model many are used to for auto or renters insurance, high-risk homeowners policies often require working with independent agents or specialty wholesalers. These intermediaries have access to niche carriers—but even they are seeing those options vanish.

This complicated distribution model means the average consumer can't easily shop online for coverage or compare quotes. Multiple Reddit users complained of calling over a dozen agents and still not finding a viable policy. Some noted the irony of having to pay thousands upfront for something they felt wouldn't even cover them if disaster struck.

Community-Powered Problem Solving

A notable aspect of the Reddit post—and many others like it—is that communities are becoming a key part of the solution. With little help available through traditional channels, people are turning to platforms like Reddit, Facebook groups, and Nextdoor to share experiences, ask for advice, and crowdsource solutions. In some cases, users recommended agents or brokers they had luck with, while others offered insight into lesser-known options like surplus lines carriers or mitigation-based discounts.

These digital spaces have become informal support networks. Whether it’s someone uploading a sample letter they used to appeal a cancellation, or another user explaining how they finally got coverage through a specialty agency in another state, the power of peer-to-peer knowledge is becoming indispensable. What used to be an industry dominated by quiet, one-on-one broker relationships is now being influenced by public, collective problem-solving online.

Challenges Ahead: A System Under Strain

The Reddit post underscored several challenges facing the high-risk homeowners insurance market:

- Climate Change – More frequent and severe natural disasters have made large swaths of the U.S. uninsurable under traditional models.

- Reinsurance Crisis – Behind the scenes, global reinsurers are tightening limits or exiting high-risk zones, driving up costs for primary insurers.

- Regulatory Constraints – In states like California, insurance departments cap rate increases, limiting carriers' ability to price for actual risk, which leads to market exits.

- Technology Gap – Most insurance tech platforms aren’t built to handle complex, high-risk cases, creating inefficiency and confusion for agents and homeowners alike.

What Reddit Reveals

While Reddit may not be a formal focus group, it’s often an early indicator of consumer frustration. This post revealed deep dissatisfaction with both the availability and delivery of high-risk homeowners insurance. Homeowners feel abandoned, and agents feel powerless. Most importantly, many users expressed a shared sense of helplessness—being told to protect their homes while simultaneously being denied the tools to do so.

But amid the chaos, one encouraging trend emerged: people are helping each other. Through online communities, they are educating one another, exposing flaws in the system, and pushing for more transparency and options. If Reddit is any indication, the industry has a long way to go to rebuild trust and provide real solutions. But homeowners aren't waiting quietly. They're organizing, sharing, and fighting back—together.